Paycheck calculator with overtime and taxes

Overtime Hourly Wage. Financial advisors can also help with investing and financial planning - including retirement homeownership insurance and more - to make sure you are preparing for the future.

Self Employment Ledger Forms Inspirational Self Employment Ledger Template 13 Trust Account Ledger Bookkeeping Templates Payroll Payroll Template

There are four tax brackets that range from 259 and 450.

. One way you can affect your take-home. Financial advisors can also help with investing and financial planning - including retirement homeownership insurance and more - to make sure you are preparing for the future. Overview of Illinois Taxes Illinois has a flat income tax of 495 which means everyones income in Illinois is taxed at the same rate by the state.

That includes overtime bonuses commissions awards prizes and retroactive salary increases. These taxes are used to pay for important social programs namely Social Security and Medicare. Of course youll have federal taxes deducted from each paycheck along with your state taxes.

Pay FUTA unemployment taxes. How You Can Affect Your West Virginia Paycheck. Arizona has a progressive tax system with varying rates depending on your income level.

This includes overtime commission awards bonuses payments for non-deductible. A financial advisor in South Carolina can help you understand how taxes fit into your overall financial goals. Overtime Hours per pay period.

Financial advisors can also help with investing and financial plans including retirement homeownership insurance and more to make sure you are preparing for the future. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. A financial advisor in New York can help you understand how taxes fit into your overall financial goals.

This calculator is intended for use by US. Overview of Maryland Taxes Maryland has a progressive income tax system with rates that range from 200 to 575. You can choose between weekly bi-weekly semi-monthly monthly quarterly semi-annual and annual pay periods and between single married or head of household.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. How You Can Affect Your New York Paycheck. If you want to boost your paycheck rather than find tax-advantaged deductions from it you can seek what are called supplemental wages.

Overview of Michigan Taxes Michigan is a flat-tax state that levies a state income tax of 425. Financial advisors can also help with investing and financial plans including retirement homeownership insurance and more to make sure you are preparing for the future. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Your employer will withhold money from your paycheck to cover the taxes in the state where you work if that state has income taxes. If you want to adjust the size of your paycheck first. How Your Ohio Paycheck Works.

Overview of Maine Taxes Maine has a progressive income tax system that features rates that range from 580 to. If you need a little extra help running payroll our calculators are here to help. Federal Income-- --State Income-- --.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. How You Can Affect Your Minnesota Paycheck. If you arent sure how much to withhold use our paycheck calculator to find your tax liability.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Gross Paycheck --Taxes-- --Details. The calculations are even tougher in a state like Ohio where there are state and often local income taxes on top of the federal tax withholding.

Overview of Arizona Taxes. Use your gross pay 62 for Social Security taxes. If you work and earn income you will almost always have to pay additional taxes called payroll taxes.

Unfortunately the tax you pay to the federal government isnt just an income tax. Calculating your paychecks is tough to do without a paycheck calculator because your employer withholds multiple taxes from your pay. Employers are solely responsible for paying federal unemployment taxes.

The tax rate is 6 of the first 7000 of taxable income an employee earns annually. So your big Texas paycheck may take a hit when your property taxes come due. It can be a challenge to predict the size of your paycheck because money is deducted for FICA federal and state income taxes as well as other withholdings.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. But when you start a new job youll have to fill out a W-4 form. Double check your calculations for hourly employees or make sure your salaried employees get the right take home pay.

If youre already living well within. If your company is required to pay into a state unemployment fund you may be eligible for a tax credit. Overview of Alabama Taxes Alabama has income taxes that range from 2 up to 5 slightly below the national average.

Overview of Colorado Taxes Colorado is home to Rocky Mountain National Park upscale ski resorts and a flat income tax rate of 45. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Deduct federal income taxes which can range from 0 to.

How You Can Affect Your Texas Paycheck. There are no local income taxes. If you consistently find yourself owing.

A financial advisor in Minnesota can help you understand how taxes fit into your overall financial goals. Overview of Georgia Taxes Georgia has a progressive income tax system with six tax brackets that range from 100 up to 575. Well show you the payroll taxes overtime rates and everything else you need to get those paychecks right this time.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. A financial advisor in West Virginia can help you understand how taxes fit into your overall financial goals.

It can also be used to help fill steps 3 and 4 of a W-4 form. With Gustos Florida Hourly Paycheck Calculator you can see how taxes affect your employees paychecks and youre ready to cut those checks and. Overview of Federal Taxes When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs.

How Your Vermont Paycheck Works. Your Vermont employer uses the information you provide on this form - with regard to your. The paycheck calculator is designed to estimate an employees net pay after adding or deducting things like bonuses overtime and taxes.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Under the Fair Labor Standards Act hourly non-exempt workers must be paid at least one and one-half times their regular rate of pay for any hours worked over 40 hours in a week. Please keep in mind that this calculator is not a one-size-fits-all solution.

If you find yourself always paying a big tax bill in April. This online paycheck calculator with overtime and claimed tips will estimate your net take-home pay after deductions and federal state and local income tax withholding. How You Can Affect Your South Carolina Paycheck.

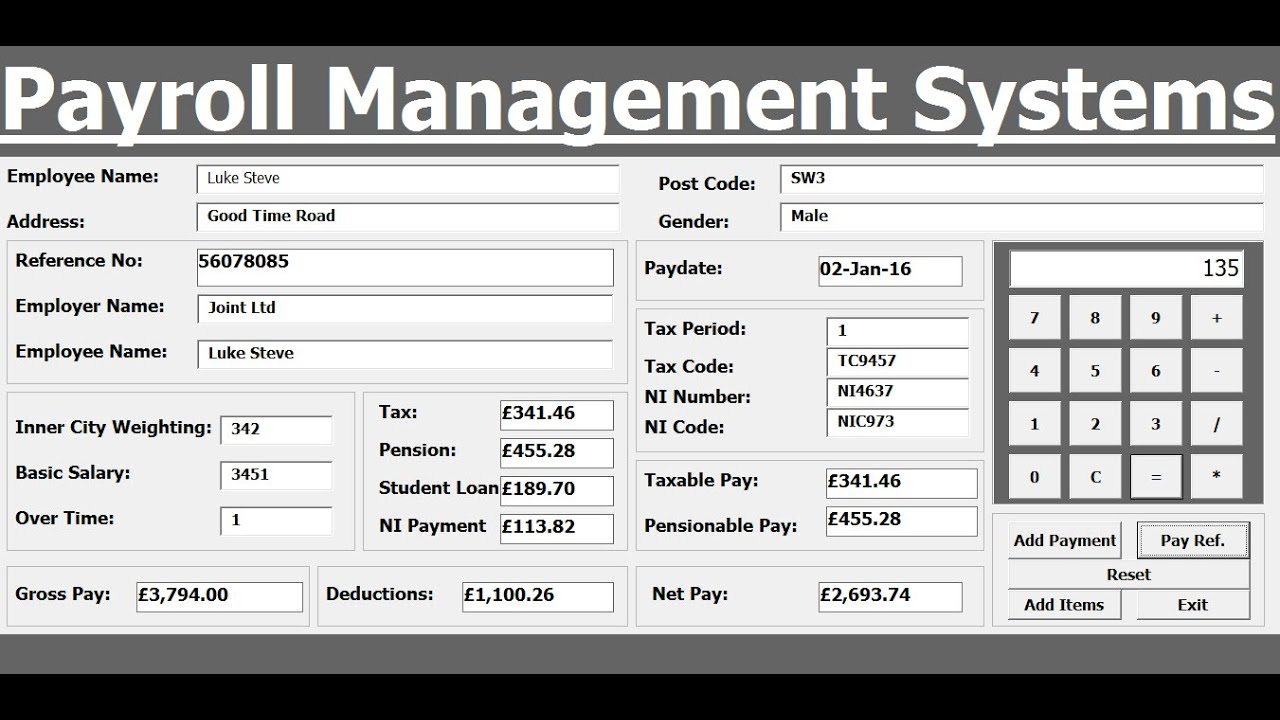

How To Create Payroll Management Systems In Excel Using Vba Youtube Payroll Management Excel

Idaho Retirement Tax Friendliness Retirement Calculator Financial Advisors Retirement

Hourly Paycheck Calculator Hourly Payroll Calculator Payroll Paycheck Calculator

Building Maintenance Checklist Templates 7 Free Docs Xlsx Pdf Maintenance Checklist Checklist Template Checklist

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Idaho Retirement Tax Friendliness Retirement Calculator Financial Advisors Retirement

Idaho Retirement Tax Friendliness Retirement Calculator Financial Advisors Retirement

Free Weekly Payroll Tax Worksheet Payroll Taxes Payroll Template Payroll Checks

Pay Stub Examples And Importance Is Our Article Which Is Meant To Provide Basic Details About Pay Stub Formats Payroll Template Good Essay Resume Template Free

Cat 2018 Response Sheet Released Answer Key Expected Next Week Aftergraduation Paycheck Investing Money Life Hacks

How To Create Payroll Management Systems In Excel Using Vba Youtube Payroll Management Excel

Idaho Retirement Tax Friendliness Retirement Calculator Financial Advisors Retirement

Balance Sheet Templates 15 Free Docs Xlsx Pdf Balance Sheet Template Balance Sheet Accounting